How-to Replace your Odds of Bringing An enthusiastic OAS Mortgage?

- Provide Files Really loan providers have a tendency to require a minumum of one little bit of photo personality (awarded from the bodies) to ensure the address and you may home updates. Acceptable files tend to be your passport and you will/otherwise license.

The initial foundation is your revenues, so that you must provide proof of the OAS payments, also any money you will be making off a job or other authorities subsidies, such as CPP (Canada Type of pension).

- Rating Funded When you offer all the necessary data, your lender often comment your application. In the event the recognized, you’re getting your own money via e-transfer or direct deposit in this twenty four-2 days.

Conditions For getting An OAS Loan

Check out of the items lenders will generally browse on when you submit an application for a loan to your OAS:

- Individual Term Advice As stated, you must be an excellent Canadian resident or permanent citizen to put on for a loan while on OAS. You might also need to incorporate details such as your title, address, time from beginning and you will Societal Insurance coverage Count (SIN).

- Financial Advice Loan providers will likely then test thoroughly your income (and additionally OAS facts), work position, expense and credit score to ensure your capability to make repayments. The fresh new more powerful this type of facets are, the easier and simpler it is to be eligible for a favorable mortgage.

- Banking Pointers Immediately following, the financial institution may ask for a void cheque otherwise pre-licensed debit setting so they are able put your loan and you will withdraw payments.

Evaluate Lenders

Ahead of implementing, don’t forget to shop around and check out numerous resources of borrowing from the bank for the best financing and you will rates of interest. Every lender has different requirements for their financing, so it’s important to research thoroughly and pick a loan provider whoever minimal requirements your fulfill to boost your chances of approval.

Make an application for A little Mortgage

To boost your chances of acceptance, believe applying for a tiny financing, sufficient to cover their really very important will set you back. Straight down loan amounts wil dramatically reduce the risk for the bank and raise your likelihood of getting financing with less desire speed and you can a very flexible label.

Replace your Borrowing

Credit ratings is an indication of one’s ability to pay back your own mortgage timely. When you have poor credit, lenders was less likely to accept you. A good credit score out of 650 to 900 is the better way of getting a beneficial loan while you’re with the OAS.

Select An excellent Cosigner

If you fail to meet the https://www.speedycashloan.net/loans/pre-approved-personal-loan/ requirements by yourself, you could increase your potential from the shopping for a cosigner which have an excellent best money and you may credit rating than simply a. Just remember so you can warn them regarding prospective outcomes out of a good guarantor loan (i.elizabeth. they will become accountable for your payments if you can’t make certain they are)

Get A protected Loan

To boost your odds of qualifying for a financial loan into the OAS, you might offer an asset due to the fact collateral, like your vehicle or domestic. Particularly an effective cosigner, security decreases the chance towards the bank. Become careful here, as they can lawfully offer the latest house for many who miss also of several money.

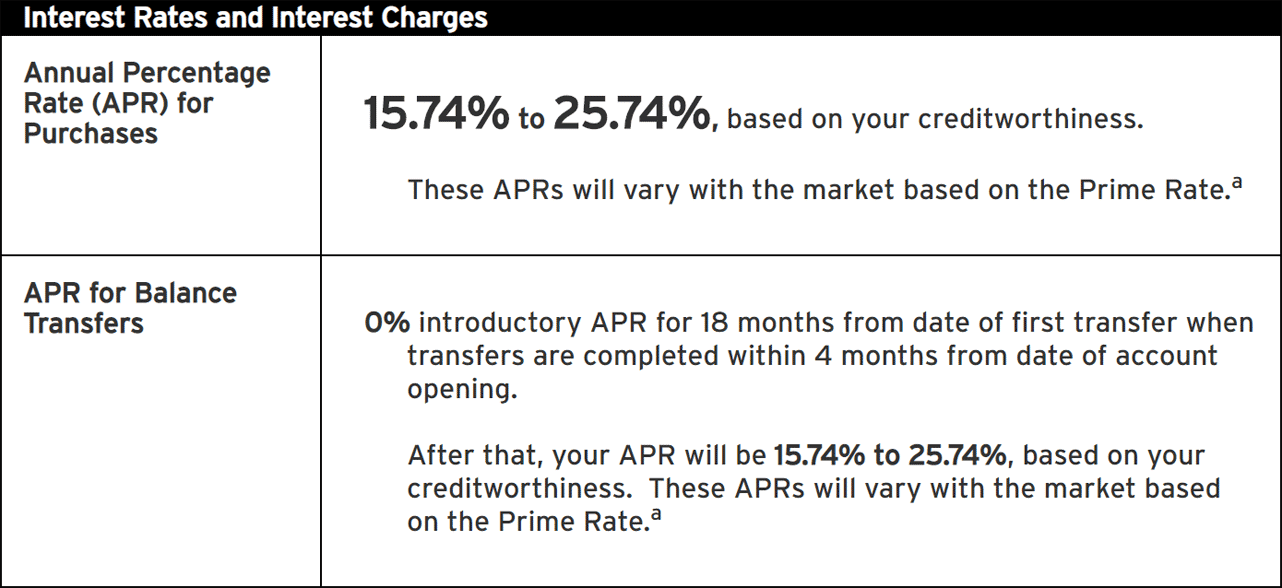

- Desire Desire is the largest cost you are going to need to imagine once you rating a loan, whether you are playing with OAS or any other particular income to help you pay it off. Interest rates and you will payment criteria cover anything from bank so you can lender but, generally speaking, the new worse their credit and you may earnings is, the greater your rate might possibly be.

- Term The loan’s percentage term may affect your own rate of interest too. Generally, prolonged words can result in you to spend far more appeal along the span of your loan.